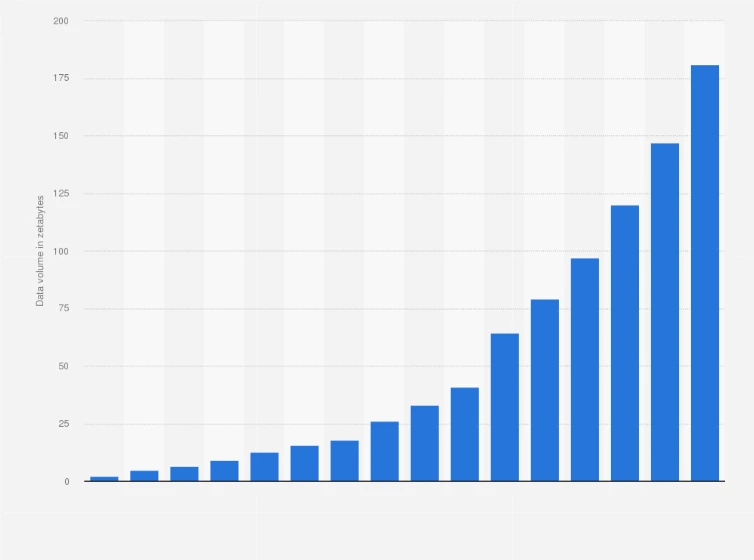

When we live in a data-driven world, you cannot make strategic decisions without fetching and evaluating data. Top data visualization tools for businesses have revolutionized how business strategies are planned and developed. Similarly, financial reporting with advanced data visualization techniques has enabled companies to make informed and accurate decisions especially when tons of data are generated every minute worldwide. Statista quotes that global data creation is likely to grow to more than 180 zettabytes by 2025.

With unambiguous and scattered data, it is difficult to build business strategies in any sector. Like other companies, finance companies identify the latest trends and optimize their operations by transforming complex financial data into clear information. Today, data visualization in the finance sector is not unknown to anyone. This comprehensive guide will show how data visualization services holistically help a company with its finance planning. Let’s begin with the basics:

What is financial reporting and how data visualization is essential?

Financial reporting is the process of tracking and concluding an organization’s fiscal performance. Such reporting provides stakeholders with important insights keeping business logic and goals into account. Data visualization in business intelligence plays an essential role as it transforms raw financial data into intuitive visual forms like graphs and charts.

Data visualization consulting services sought by finance companies help stakeholders easily interpret complex information and the hottest trends in the market to make informed decisions for their company. This enhances accuracy, strategic planning, and transparency within the organization.

Visual finance – the dawn of a new era

The rise of advanced financial data visualization techniques has transformed the way finance reporting happens. Finance companies now quickly grasp the latest trends and read between the lines to make strategic decisions through financial data and financial graphs.

Here are the factors that make visual finance an essential tool:

Turns data into insights

Financial data visualization techniques allow organizations to convert enormous amounts of financial data into meaningful insights. Professional financial service analytics provide interactive dashboards and graphs that show important trends, patterns, and anomalies. This helps companies and stakeholders to spot opportunities and assess risks. A visual approach like this simplifies the subject of strategic foresight.

Simplify complex financial concepts

Data visualization services in finance often simplify details that are complex and ambiguous. Visualization methods break down complexities into actionable and understandable concepts such as profitability, cash flow, and ROI through easy-to-digest visuals. Bar charts, pie charts, tables, heatmaps, or Venn diagrams, visual tools make things easier than ever.

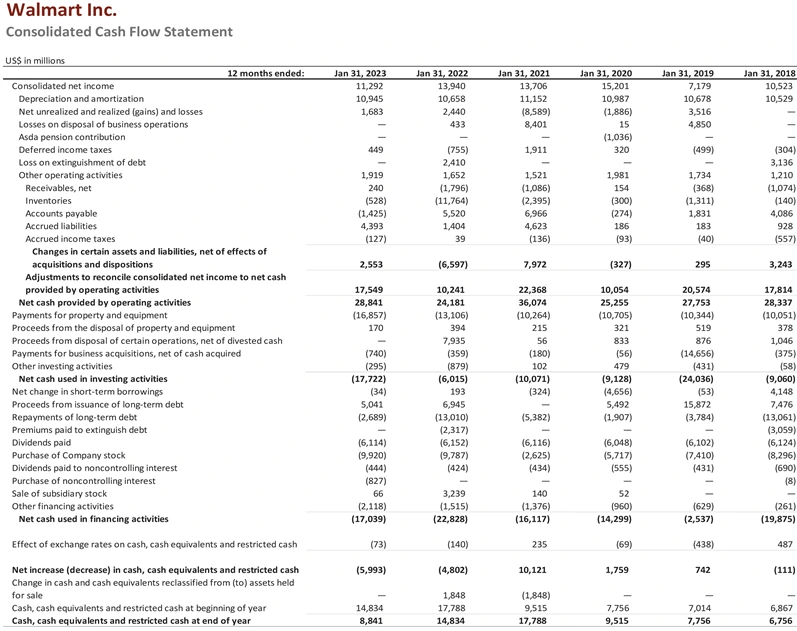

In the American Journal of Business Management under Role of Data Visualization in Finance, it’s concluded that graphs and charts or other visual tools are remarkably impressive in storytelling which is more engaging to the audience and readers. The tabular chart gives an insight into the consolidated cash flow of Walmart Inc.

Faster decision making

Today, no business can thrive without a pace in progress by taking calculated risks. This comes from data visualization in finance. Visually appealing snapshots of finance health provide real-time information. Plus, decision-makers can easily assess key performance indicators (KPIs) and compare myriad datasets to adjust strategies quickly.

Key applications of financial data visualization

Companies seek professional financial analytics services to turn complex information into easily understood insights through financial graphs and charts. This brings accurate analysis and faster decision-making to finance companies because they have actionable insights in easy language and patterns. A professional data visualization solutions company builds customized solutions to use in any application. A few real-life examples are here:

Financial performance analysis

Financial performance analysis is the backbone of any company to assess its health and make strategic decisions accordingly. Advanced data visualization techniques enable companies to track, grasp, and communicate performance metrics with ease and clarity. Ample visual tools are available to have insights into financial position and build growth strategies likewise. Here are some use cases:

Visualize key performance indicators (KPIs)

Visualizing financial data can track Key Performance Indicators (KPIs) more insightful and accurate. Visual tools like dashboards and charts can provide real-time access to essential metrics such as ROI, profit margins, and revenue growth. the stakeholders can quickly gauge financial health and align their objectives accordingly.

Track financial trends over time

Financial data visualization examples include tracking financial trends over the long term and knowing the performance shifts. Line graphs, area charts, bar charts etcetera can track revenues and other key metrics throughout regions and periods. Such financial data make it easier to spot cyclical changes, spot seasonality and growth trends to help businesses project the future.

Identify profit/loss patterns

The latest data visualization services by professional companies help organizations identify and analyze profit and loss patterns through clear income and expense data. Financial graphs, waterfall charts, heatmaps, and pie charts are a few examples to show cost allocation and pinpoint areas of leakage and unnecessary spending.

“Stay Ahead of Financial Risks!”

Transform data into insights to manage risks and adapt strategies effortlessly.

Risk management

The financial landscape changes rapidly and, therefore, effective risk management is essential. Finance companies opt for data visualization consulting services to assess and monitor while mitigating risks with greater accuracy. Visual tools further make it easier to grasp the information and take proactive measures. Here are the use cases:

Visualizing risk exposures

Financial data and financial graphs map out the risk exposures to offer an intuitive way to identify vulnerable areas. Companies can assess the likelihood of the impact of credit, operational risks, and market trends to make foolproof decisions.

Market volatility monitoring

Financial data visualization especially through heatmaps and dynamic charts is known to have vigilance on market volatility. Such techniques help finance companies track fluctuations in asset prices, commodity values, and currency rates as they happen. Ultimately, the companies get a clearer view of the market and hence they can swiftly build strategies or act.

Simulating ‘what-if’ probabilities

Data visualization in finance can anticipate and calculate ‘what-if’ situations to test the impact of myriad financial actions and outcomes. Such a predictive approach can prepare one for potential market shifts, unexpected downturns, and economic events in the future. it’s easy to build strategies and minimize exposure to risks while maximizing resilience.

Finance forecasting and budgeting

Forecasting and budgeting go hand in hand in the finance sector where data visualization services play an essential role. Companies can project financial uncertainties and plan their budgets accordingly. They can take calculated risks and allot resources accordingly to save themselves from loss.

Interactive forecasting models

Data visualization services can be customized to produce interactive forecasting models to present accurate predictions in dynamic and readable ways. Such models will allow top management to adjust variables and assumptions to view immediate or late impact on their business. Companies with readable financial graphs can also gain flexibility in planning and a deeper understanding of potential investment outcomes.

Visualize budget variances

Visualizing budget variances is an essential tool for any finance analysis. Some of the financial data visualization examples in this regard include color-coded charts, and line and bar graphs. They help quickly identify the actual spending and any deviation from the budget. Organizations can pinpoint variances and optimize their budgets.

Identify cost-saving areas

Advanced data visualization techniques can help organizations track cost-saving chances through spending patterns based on information fetched from various sources. Businesses can uncover inefficiencies, optimize resource deployment, and reduce unnecessary spending by data visualization in finance.

Investor relations

Investor relations teams are heavily relying on the latest financial data visualization tools to communicate financial performance unambiguously. Finance companies enhance transparency and build trust by presenting balance sheets in engaging visuals to investors and stakeholders to win their trust. Here are some of the prime examples:

Building presentations for investors

Data visualization can create engaging and persuasive investor presentations. Financial data and financial graphs such as infographics offer a more compelling and convincing way to showcase financial data. This can effortlessly convince investors as they can grasp key metrics with ease. Visual storytelling makes complex finance data simple and communicable.

Real-time finance update

Real-time financial updates are essential to maintain investors’ trust. Interactive dashboards and real-time visualizing financial data enable investors to access the latest information like growth metrics, earnings, and market performance. Such transparency will make investors happier and more confident.

Inducing transparency and trust

Financial data visualization techniques provide the best insight into the finance ecosystem which is clear, accurate, and quicker. Through charts, heatmaps, and graphs, interactive dashboards are prepared and stakeholders can get a comprehensive and digestible view of their financial health. This improves transparency and trust.

Advanced visualization techniques in finance

A professional data visualization solutions company is capable of making advanced techniques and tools to unlock deeper insights from scattered and messy financial data. From all-in-one dashboards to predictive analysis, there are case studies of personalized financial analytics services that have enabled companies to manage their finance all under one dashboard and present their fiscal performance. Here are some use cases:

Interactive dashboards

Data visualization in finance is performed in myriad ways – interactive dashboards being the one. This allows stakeholders to explore many metrics and make decisions accurately and quickly. Such dashboards offer comprehensive and customizable views so that the users can focus on specific financial aspects linked to their interests such as profit margin, operational costs, and liquidity.

Real-time insights for finance performance

Real-time dashboards are known to provide up-to-the-minute data on a company’s fiscal performance through revenue insights, cash flow, and expenses. Finance executives can monitor business health quite regularly and identify emerging issues and thus make proactive measures. Real-time insights also empower finance companies to stay alert for unwanted market fluctuations.

Customizable views as per the user

Different stakeholders can get different views of the dashboard as a part of financial data visualization. For example, finance executives can focus on top-level market trends while finance teams can drill down to particular budget types or operational expenses. This customization will make sure that each user gets relevant and tailored information.

Geographic data visualization

One can analyze financial performance by filtering regions and/or markets through geographic data visualization in finance. It is possible to uncover opportunities and identify regional finance pulse through mapping.

Regional mapping

Geographic visualization such as choropleth maps and heatmaps are used to have a clear view of fiscal performance region-wise. Such financial data visualization examples help businesses to know revenue, profitability, and market share in a specific city, state, or country.

Identify regional trends

Grab opportunities for a specific reason based on data. Geographic data visualization in finance can unveil regional trends and identify upcoming investment potential. Finance companies can spot untouched markets, allocate investment more effectively, or plan pricing strategies by having financial metric analysis according to a region.

Predictive analytics and Machine Learning

When combined with financial data visualization, predictive analytics, and Machine Learning technologies can render powerful tools capable of forecasting financial performance. Such techniques make businesses capable of predicting future trends and identifying hidden patterns to uncover potential risks or grab opportunities. Here are some use cases:

Forecast future financial performance

Predictive analytics are based on historical financial data and present trends to anticipate future demands. Visualization such as trend lines and predictive models enable companies to forecast revenues, growth opportunities, and expenses. Ultimately, finance companies can set realistic targets and plan budgets accordingly.

Alert fraudulent activities

Data visualization in finance can also pick anomalies and hence be used to identify any malpractices and irregularities in financial transactions. Visual highlighting outliners can make businesses track potential frauds and accounting errors so that they can improve security and ensure financial integrity.

“Unlock the Power of Data Storytelling!”

Engage stakeholders with visual insights and actionable stories.

Data storytelling

Data storytelling includes financial data visualization to communicate complex datasets in a compelling narrative which turns raw finance information into stories easy to understand and engage users. Businesses use data storytelling to communicate their financial journey, challenges, and solutions to overcome them resonating with stakeholders. Here are the use cases:

Create compelling narratives from data

Data storytelling simplifies complex financial information that’s engaging and understandable. It weaves together visuals, key metrics, and charts to communicate growth trajectory and strategic initiatives.

Engaging audience

Data storytelling engages audiences through visually appealing and narrative-driven forms of information. Charts, animations, and infographics are a few ways to capture attention and facilitate clarity. This engages stakeholders and they make quicker decisions.

The prospects of visual finance data

The future of finance data visualization is poised for unprecedented growth with Artificial Intelligence and Machine Learning. The technologies will advance and businesses will have deeper and enhanced predictive capabilities with automation and real-time data churn.

Ready for the transformative impact of financial data visualization?

All in all, advanced data visualization in finance is transforming financial reporting, investor relations, and risk management along with forecasting. More finance companies will embrace data visualizing tools to get a competitive edge and induce better transparency in business. The time is now to build a customized financial data visualization tool for your business.